General

Terms and Definitions

- System — TipTop Pay payment gateway.

- Merchant — TipTop Pay client who works with the System.

- Control panel — merchant's control panel in the system, located at merchant.tiptoppay.mx

- Card — a bank card of Visa, MasterCard, American Express or Carnet.

- Acquirer — a settlement bank.

- Issuer — a bank that issued a card.

- Cardholder — an owner of a card issued by a bank.

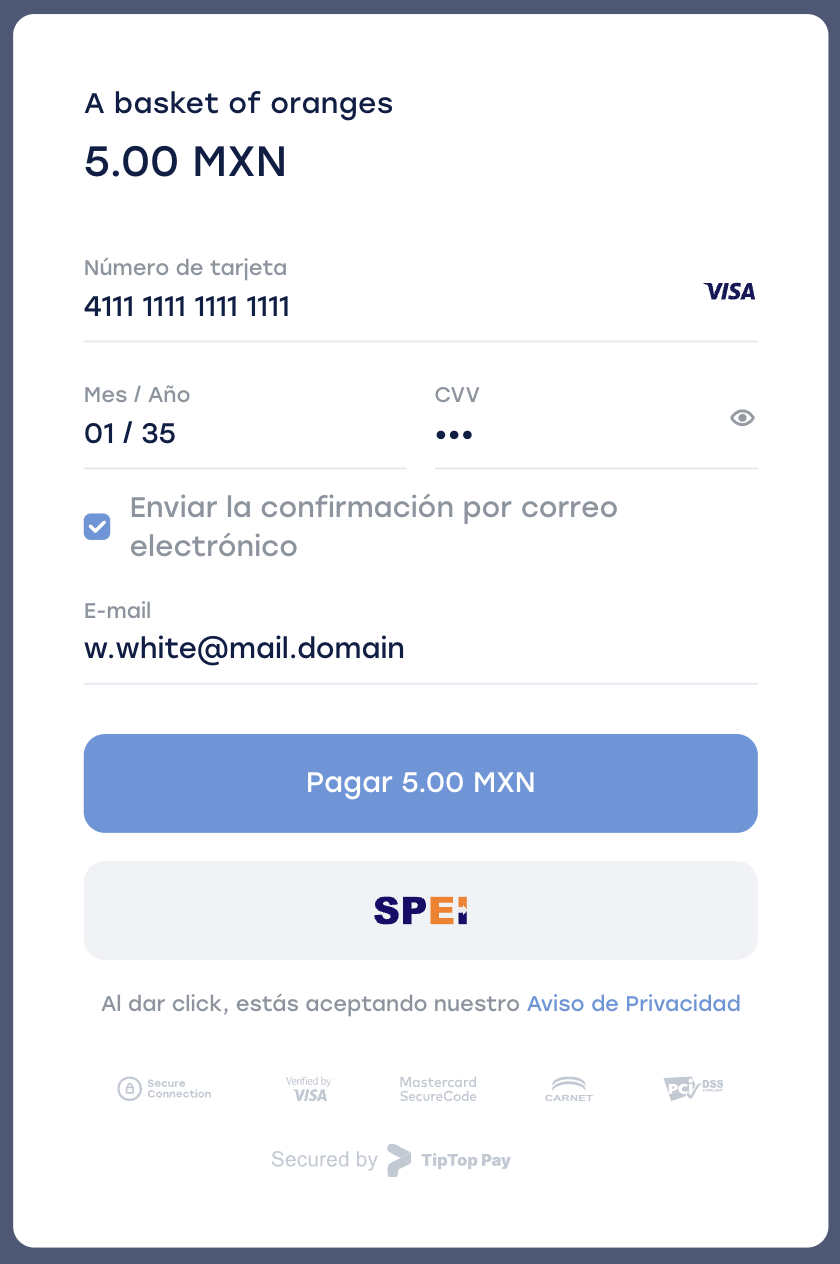

- Widget — payment form, provided by the system to enter card data by a holder and perform a further authorization.

- 3-D Secure — protocol to verify a holder by the issuer.

Transaction Types

The system involves two types of operations: payment and refund. In the first case, money is transferred from holder's account to the merchant, in the second - vice versa. A merchant performs a refund if a buyer wants to return goods, and it is always associated with a payment transaction, which amount returns to a holder. It is possible to refund a whole payment amount or it's part only. Money usually comes back to a holder’s card the same day, but sometimes (it depends on an issuer) it can take up to 3 days.

Payment Methods

A payment can be made using following methods:

- Via payment form — widget. Add a script that opens a secure payment form (iframe) to enter card data.

3-D Secure

3-D Secure is a common name of Verified By Visa and MasterCard Secure Code programs from Visa and MasterCard's respectively. In general, such program shall authenticate a cardholder (that is to protect against an unauthorized card usage) by an issuer before a payment. Actually, it looks as follows: a cardholder specifies card data. Then the issuer’s web site opens, where a cardholder has to enter a password or a secret code (usually, the code is sent in a SMS message). If the code is correct, a payment will be successful. Otherwise, it will be rejected.

Plugins for CMS

WooCommerce

All versions are supported

The installation instructions can be found in the file.

PrestaShop

Currently supported versions – 1.7 or later

Please contact [email protected] for assistance with installing the plugin for this CMS.

Magento

Currently supported versions – 2.0 or later

Please contact [email protected] for assistance with installing the plugin for this CMS.

Ecwid / Lightspeed E-Series

Please contact [email protected] for assistance with installing the plugin for this CMS.

SDK for iOS

SDK allows you to integrate payment acceptance into a mobile application for iOS platform. The main version is on GitHub.

SDK for Android

SDK allows you to integrate payment acceptance into a mobile application for Android platform. The main version is on GitHub.

Payment Widget

Payment widget is a pop-up form to enter card data and payer’s email address. The widget automatically defines a payment system type: Visa, MasterCard, American Express, or Carnet, and an emitting bank of a card and corresponding logos. The form is optimized for use in any browsers and mobile devices. There is an iframe opens within a widget which guarantees a security of card data sending and does not require a certification for merchant's usage.

Widget Installation

To install a widget, you need to add a script on a web site to the head section:

<script src="https://widget.tiptoppay.mx/bundles/widget.js"></script>

Define a function for charge methods calling for payment form to display:

this.pay = function () {

var widget = new tiptop.Widget();

widget.pay('charge',

{ //options

publicId: 'test_api_00000000000000000000001', //id of site (from control panel)

description: 'Payment example (no real withdrawal)', // purpose/justification/description

amount: 10,

currency: 'MXN',

accountId: '[email protected]', //customer's/user's/payer's ID (optional)

invoiceId: '1234567', // order number (optional)

data: {

myProp: 'myProp value' //arbitrary set of parameters

}

},

{

onSuccess: function (options) { // success

//action upon successful payment

},

onFail: function (reason, options) { // fail

//action upon unsuccessful payment

},

onComplete: function (paymentResult, options) { //It is called as soon as the widget receives a response from api.tiptoppay with the result of the transaction.

//e.x. calling your Facebook Pixel analytics

},

onPendingPayment: function() { // The function is called when creating a cash payment transaction (displaying a barcode to the customer)

// example...

}

}

)

};

Call the function when some event is emitted, for example click on the «Pay» button:

$('#checkout').click(pay);

Parameters

A call of charge function defines a payment scheme:

- charge for single

| Parameter | Type | Use | Description |

|---|---|---|---|

| publicId | String | Required | A web site identifier; located in Control panel |

| description | String | Required | Description of a payment purpose in any format |

| amount | Float | Required | Payment amount |

| currency | String | Required | Currency: MXN (see the reference) |

| accountId | String | Required | Payer's ID (endpoint customer) |

| invoiceId | String | Optional | Order or Invoice number |

| String | Optional | E-mail of that user | |

| requireEmail | bool | Optional | Require user's email address to be specified in the widget |

| retryPayment | bool | Optional | Display the "Repeat payment" button if the payment is unsuccessful. (true is default) |

| disableEmail | bool | Optional | Is a parameter that allows you to hide the e-mail block on the widget. To hide the block, you must not pass the requireEmail parameter or pass it the value false |

You can define the form behaviour for successful or unsuccessful payment using the following parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| onSuccess | Function or String | Optional | Either a function or a web site's page is specified. If a function is specified, it will be called after successful payment completion. If a page is specified, a payer will be directed to a specified page |

| onFail | Function or String | Optional | Either a function or a web site's page is specified. If a function is specified, it will be called after unsuccessful payment completion. If a page is specified , a payer will be directed to a specified page. |

| onComplete | Function | Optional | A function is specified that will be called as soon as the widget receives a response with the result of the transaction. You cannot make redirects in this method. |

| onPendingPayment | Function or String | Optional | Either a function or a web site's page is specified. If a function is specified, it is invoked when a cash payment transaction is created. If a page is specified, a payer will be directed to a specified page. |

Widget Localization

The widget is in Spanish by default. You need to add the language parameter in the widget to localize it:

var widget = new tiptop.Widget({language: "es-ES"});

List of supported languages:

| languages | Timezone | Value |

|---|---|---|

| Spanish | UTC | es-ES |

Checkout

DEMO CHECKOUT

Both test and real card details can be used for testing. No funds will be debited.

REQUIREMENTS

FORM REQUIREMENTS:

- Must use a HTTPS connection with a valid SSL certificate.

- No field may contain a "name" attribute: this prevents card details from leaking to the server when the form is submitted.

- The card number field must allow 16 to 19 digits.

CRYPTOGRAM REQUIREMENTS:

- Must be generated exclusively by the original checkout script loaded from the system addresses.

- The cryptogram cannot be stored and reused after the payment.

PCI DSS SECURITY REQUIREMENTS:

In PCI DSS terms, this type of connection is classified as "E-commerce merchants who outsource all payment processing to PCI DSS validated third parties, and who have a website(s) that does not directly receive cardholder data but that can impact the security of the payment transaction. No electronic storage, processing, or transmission of any cardholder data on the merchant's systems or premises." This means that although payment data is processed by a third party, the website is a factor in the security of card details.

You must complete the SAQ-EP self-assessment form and pass quarterly ASV testing to meet the standard requirements.

INSTALLATION

To create a cryptogram, add the checkout script to the page with the payment form:

<script src="https://checkout.tiptoppay.mx/checkout.js"></script>

Choose a card details passing method that suits you:

- Passing to a script

- Input form

Next, send the card cryptogram you created to the server and invoke the payment method via API.

PASSING THE CARD DETAILS DIRECTLY TO THE SCRIPT

1) Initialize checkout script

const checkout = new tiptop.Checkout({

publicId: 'test_api_000000000000000002',

});

2) Invoke the cryptogram generation method by passing the card details to it

const fieldValues = {

cvv: '911',

cardNumber: '4242 4242 4242 4242',

expDateMonth: '12',

expDateYear: '24',

}

checkout.createPaymentCryptogram(fieldValues)

.then((cryptogram) => {

console.log(cryptogram);

}).catch((errors) => {

console.log(errors)

});

USING THE INPUT FORM:

1) Create a form for entering the card details: The card details input fields are to be marked with the following attributes:

<form id="paymentFormSample" autocomplete="off">

<input type="text" data-ttp="cardNumber">

<input type="text" data-ttp="expDateMonth">

<input type="text" data-ttp="expDateYear">

<input type="text" data-ttp="cvv">

<input type="text" data-ttp="name">

<button type="submit">Оплатить 100 р.</button>

</form>

- data-ttp="cardNumber" — card number field;

- data-ttp="expDateMonth" — expiration month field;

- data-ttp="expDateYear" — expiration year field;

- data-ttp="cvv" — CVV code field;

- data-ttp="name" — cardholder name field.

2) Initialize checkout script

const checkout = new tiptop.Checkout({

publicId: 'test_api_000000000000000002',

container: document.getElementById("paymentFormSample")

});

3) Invoke the cryptogram generation method

checkout.createPaymentCryptogram()

.then((cryptogram) => {

console.log(cryptogram); // cryptogram

}).catch((errors) => {

console.log(errors)

});

WHEN DESIGNING YOUR OWN FORM OR PASSING DATA TO A SCRIPT, MIND THE FOLLOWING POINTS:

- card number can be 16 (15 for AMEX) to 19 digits long. Find out more here;

- The checkout script will not work with outdated, unsafe browsers that do not support TLS encryption protocols v1.1 or higher. Examples include Internet Explorer 7;

- The 3DS window can be displayed either in a new window or in a frame over a page. The window size must be at least 500x500 pixels.

METHODS

ASYNCHRONOUS CRYPTOGRAM GENERATION METHOD

With this method, when a card details validation error occurs, you get an error code (see example below) instead of a localized message.

async createPaymentCryptogram(fieldValues: CardData): Promise<string>

The method returns a Promise containing the cryptogram. If invalid data is passed, the Promise will be declined with an error containing an object with the error list.

const checkout = new tiptop.Checkout({

publicId: 'test_api_000000000000000002'

});

const fieldValues = {

cvv: '911',

cardNumber: '4242 4242 4242 4242',

expDateMonth: '12',

expDateYear: '24',

}

checkout.createPaymentCryptogram(fieldValues)

.then((cryptogram) => {

console.log(cryptogram);

});

CARDDATA OBJECT DESCRIPTION:

export interface CardData {

cvv?: string; // CVV/CVC code

cardNumber?: string; // Card number, spaces are ignored

expDateMonth?: string; // Card expiration date – month

expDateYear?: string; // Card expiration date – year

expDateMonthYear?: string; // Card expiration date, all characters except digits are ignored,

//If the string is 2, 3, or 5 characters long, the first digit is interpreted as the month and the rest, as the year.

//If the string is 4 or 6 characters long, the first two characters are interpreted as the month and the rest, as the year.

}

| Parameter | Description | Type | Mandatory * |

|---|---|---|---|

| cvv | CVV/CVC | string | No * |

| cardNumber | Card number, spaces are ignored | string | Optional if the field is linked on the form |

| expDateMonth | Card expiration date – month | string | Optional if the field is linked on the form or the expDateMonthYear field has been passed |

| expDateYear | Card expiration date – year | string | Optional if the field is linked on the form or the expDateMonth and expDateYear fields have been passed |

| expDateMonthYear | Card expiration date, all characters except numbers are ignored. If the string is 2, 3, or 5 characters long, the first digit is interpreted as the month and the rest, as the year. If the string is 4 or 6 characters long, the first two characters are interpreted as the month and the rest, as the year. | string | Optional if the field is linked on the form or the expDateMonth and expDateYear fields have been passed |

| name | Cardholder name | string | No |

HANDLING CARD DETAILS VALIDATION ERRORS:

const fieldValues = {

cvv: '91', // Invalid CVV

cardNumber: '4242 4242 4242 424', // Invalid card number

expDateMonth: '12',

expDateYear: '24',

}

checkout.createPaymentCryptogram(fieldValues)

.then((cryptogram) => {

console.log(cryptogram);

})

.catch((errors) => {

console.log(errors);

/* Prints

{

cardNumber: "CardNumber_Invalid,"

cvv: "Cvv_Invalid"

}

*/

});

| Error code | Description |

|---|---|

| CardNumber_Empty | Blank card number |

| CardNumber_Invalid | Invalid card number |

| Cvv_Empty | Blank CVV |

| Cvv_Invalid | Invalid CVV |

| ExpDateMonthYear_Empty | Blank year and month |

| ExpDateMonthYear_Invalid | Invalid year and month |

| ExpDateMonth_Empty | Blank month |

| ExpDateMonth_Invalid | Invalid month |

| ExpDateYear_Empty | Blank year |

| ExpDateYear_Invalid | Invalid year |

| Name_Empty | Blank name * |

| Name_Invalid | Invalid name * |

| Name_TooLong | Name too long * |

| Name_TooShort | Name too short * |

CRYPTOGRAM GENERATION METHOD

This method will return a cryptogram if generated successfully, or an error list object in the event of a card details error. Unlike the createPaymentCryptogram method, the error list object contains localized descriptions of errors, not error codes

This method accepts a card details object as input, or it can be used in the legacy scheme involving a linked HTML form. Where the linked form is used and the same parameter is also found in the CardData object, an error will be returned when the attempt is made to generate a cryptogram.

Script for creating a cryptogram:

this.createCryptogram = function () {

var result = checkout.createCryptogramPacket();

if (result.success) {

// cryptogram generated

alert(result.packet);

}

else {

// data input errors found, `result.messages` object in the following format:

// { name: "Cardholder name has too many characters," cardNumber: "Invalid card number" }

// where `name`, `cardNumber` correspond to the values of the `<input ... data-cp="cardNumber">` attributes

for (var msgName in result.messages) {

alert(result.messages[msgName]);

}

}

};

$(function () {

/* Creating checkout */

checkout = new tiptop.Checkout(

// public id from Personal Account

"test_api_00000000000000000000001",

// tag containing card data fields

document.getElementById("paymentFormSample"));

});

API

API refers to the system's application programming interface for interoperation with merchant systems.

The interface, which runs at api.tiptoppay.mx, supports making payments, canceling payments, making refunds, completing two-step payments, creating and canceling recurring subscription payments, and mailing invoices.

Principle of operation

- The parameters are passed via POST in the request body, either in "key=value" or in JSON format.

- The API can accept no more than 150,000 fields per request. The API response timeout is 5 minutes.

- In all requests to the API: if you pass a number with a decimal point into an integer field, there will be no error, but the number will be mathematically rounded to an integer.

- The API has a limit on the maximum number of requests that can be sent simultaneously: 5 for test terminals and 30 for production terminals. When the number of concurrently processed requests to the website exceeds the limit, the API will return a response with the HTTP 429 (Too Many Requests) code until the processing of at least one request is completed. Contact your personal manager if you need to revise the limits.

The choice of parameter passing format is determined client-side and controlled via the Content-Type request header.

- For "key=value" parameters Content-Type: application/x-www-form-urlencoded;

- For JSON parameters Content-Type: application/json;

The system will respond in JSON format, including at least two parameters: Success and Message:

{ "Success": false, "Message": "Invalid Amount value" }

Request authentication

HTTP Basic Auth is used to authenticate the request by sending the login and password in the HTTP request header. Public ID is used as the login name; API Secret is used as the password. Both of these can be found in your Personal Account.

API idempotence

Idempotence is a property of the API whereby the interface will return a result on a repeat request identical to that of the initial request without re-processing. This means that you can send multiple requests with the same ID to the system, but only one request will be successfully processed and all responses will be identical. This is a safeguard against network errors that may cause the generation of duplicate records and actions.

To enable idempotence, the API request header must contain an X-Request-ID key with a unique ID. The request ID is supposed to be generated on your side: it can be a guid, a combination of order number, date and amount, or any other value you choose.

Each new request to be processed must include a new X-Request-ID value. The system will store the result for 1 hour.

Test method

Here is a method you can invoke to test interoperation with the API.

Method URL:

https://api.tiptoppay.mx/test

Request parameters:

none.

Response example:

in response, the method will return a request status.

{"Success":true,"Message":"bd6353c3-0ed6-4a65-946f-083664bf8dbd"}

Payments by cryptogram

A method for paying with a cryptogram of payment data that results from an encryption algorithm. To generate a cryptogram, use the Checkout.

Method URL::

https://api.tiptoppay.mx/payments/cards/charge

Request parameters:

| PARAMETER | FORMAT | APPLICATION | DESCRIPTION |

|---|---|---|---|

| AMOUNT | NUMBER | Mandatory | AMOUNT IN TRANSACTION CURRENCY, SEPARATOR: DOT. NUMBER OF NON-ZERO CHARACTERS AFTER DOT: 2. |

| CURRENCY | STRING | Opcional | CURRENCY: USD/EUR/MXN (REFER TO THE DIRECTORY). IF THE PARAMETER IS NOT PROVIDED, IT DEFAULTS TO MXN. |

| IPADDRESS | STRING | Mandatory | PAYER'S IP |

| CARDCRYPTOGRAMPACKET | STRING | Mandatory | PAYMENT DATA CRYPTOGRAM |

| NAME | STRING | Opcional | CARDHOLDER'S NAME IN LATIN LETTERS |

| PAYMENTURL | STRING | Opcional | ADDRESS OF THE WEBSITE FROM WHICH THE CHECKOUT SCRIPT IS INVOKED |

| INVOICEID | STRING | Opcional | INVOICE OR ORDER NUMBER |

| DESCRIPTION | STRING | Opcional | TRANSACTION DESCRIPTION IN ARBITRARY FORM |

| CULTURENAME | STRING | Opcional | NOTIFICATION LANGUAGE |

| ACCOUNTID | STRING | Opcional | MANDATORY USER ID TO CREATE A SUBSCRIPTION AND RECEIVE A TOKEN |

| STRING | Opcional | PAYER'S EMAIL ADDRESS TO WHICH THE PAYMENT RECEIPT WILL BE SENT | |

| PAYER | OBJECT | Opcional | ADDITIONAL FIELD FOR PAYER INFORMATION. USE THE FOLLOWING PARAMETERS: FirstName, LastName, MiddleName, Birth, Street, Address, City, Country, Phone, Postcode |

| JSONDATA | JSON | Opcional | ANY OTHER DATA TO BE ASSOCIATED WITH THE TRANSACTION |

In response, the server will return a JSON of three components::

- success field — request result;

- message field — error description;

- model object — extended information.

Possible response variants:

- Invalid request:

success — false

message — error description - 3-D Secure authentication required:

success — false

model — authentication information - Transaction declined:

success — false

model — transaction information and error code - Transaction accepted:

success — true

model — transaction information

Example cryptogram payment request:

{

"Amount":10,

"Currency":"MXT",

"InvoiceId":"1234567",

"IpAddress": "123.123.123.123",

"Description":"Test",

"AccountId":"user_x",

"Name":"CARDHOLDER NAME",

"CardCryptogramPacket":"01492500008719030128SMfLeYdKp5dSQVIiO5l6ZCJiPdel4uDjdFTTz1UnXY+3QaZcNOW8lmXg0H670MclS4lI+qLkujKF4pR5Ri+T/E04Ufq3t5ntMUVLuZ998DLm+OVHV7FxIGR7snckpg47A73v7/y88Q5dxxvVZtDVi0qCcJAiZrgKLyLCqypnMfhjsgCEPF6d4OMzkgNQiynZvKysI2q+xc9cL0+CMmQTUPytnxX52k9qLNZ55cnE8kuLvqSK+TOG7Fz03moGcVvbb9XTg1oTDL4pl9rgkG3XvvTJOwol3JDxL1i6x+VpaRxpLJg0Zd9/9xRJOBMGmwAxo8/xyvGuAj85sxLJL6fA=="

"Payer":

{

"FirstName":"Test",

"LastName":"Test",

"MiddleName":"Test",

"Birth":"1955-02-24",

"Address":"test address",

"Street":"Street",

"City":"City",

"Country":"MX",

"Phone":"123",

"Postcode":"345"

}

}

Response example: invalid request:

{"Success":false,"Message":"Amount is required"}

Response example: 3-D Secure authentication required:

{

"Model": {

"TransactionId": 891463508,

"PaReq": "+/eyJNZXJjaGFudE5hbWUiOm51bGwsIkZpcnN0U2l4IjoiNDI0MjQyIiwiTGFzdEZvdXIiOiI0MjQyIiwiQW1vdW50IjoxMDAuMCwiQ3VycmVuY3lDb2RlIjoiUlVCIiwiRGF0ZSI6IjIwMjEtMTAtMjVUMDA6MDA6MDArMDM6MDAiLCJDdXN0b21lck5hbWUiOm51bGwsIkN1bHR1cmVOYW1lIjoicnUtUlUifQ==",

"GoReq": null,

"AcsUrl": "https://demo.tiptoppay.mx/acs",

"ThreeDsSessionData": null,

"IFrameIsAllowed": true,

"FrameWidth": null,

"FrameHeight": null,

"ThreeDsCallbackId": "7be4d37f0a434c0a8a7fc0e328368d7d",

"EscrowAccumulationId": null

},

"Success": false,

"Message": null

}

Response example: transaction declined. ReasonCode field contains error code (refer to the directory):

{

"Model": {

"ReasonCode": 5051,

"PublicId": "pk_**********************************",

"TerminalUrl": "http://test.test",

"TransactionId": 891583633,

"Amount": 10,

"Currency": "MXN",

"CurrencyCode": 0,

"PaymentAmount": 10,

"PaymentCurrency": "MXN",

"PaymentCurrencyCode": 0,

"InvoiceId": "1234567",

"AccountId": "user_x",

"Email": null,

"Description": "Test",

"JsonData": null,

"CreatedDate": "/Date(1635154784619)/",

"PayoutDate": null,

"PayoutDateIso": null,

"PayoutAmount": null,

"CreatedDateIso": "2021-10-25T09:39:44",

"AuthDate": null,

"AuthDateIso": null,

"ConfirmDate": null,

"ConfirmDateIso": null,

"AuthCode": null,

"TestMode": true,

"Rrn": null,

"OriginalTransactionId": null,

"FallBackScenarioDeclinedTransactionId": null,

"IpAddress": "123.123.123.123",

"IpCountry": "CN",

"IpCity": "Beijing",

"IpRegion": "Beijing",

"IpDistrict": "Beijing",

"IpLatitude": 39.9289,

"IpLongitude": 116.3883,

"CardFirstSix": "400005",

"CardLastFour": "5556",

"CardExpDate": "12/25",

"CardType": "Visa",

"CardProduct": null,

"CardCategory": null,

"EscrowAccumulationId": null,

"IssuerBankCountry": "US",

"Issuer": "ITS Bank",

"CardTypeCode": 0,

"Status": "Declined",

"StatusCode": 5,

"CultureName": "kk",

"Reason": "InsufficientFunds",

"CardHolderMessage": "InsufficientFunds",

"Type": 0,

"Refunded": false,

"Name": "CARDHOLDER NAME",

"Token": "tk_255c42192323f2e09ea17635302c3",

"SubscriptionId": null,

"GatewayName": "Test",

"ApplePay": false,

"AndroidPay": false,

"WalletType": "",

"TotalFee": 0

},

"Success": false,

"Message": null

}

Response example: transaction accepted:

{

"Model": {

"ReasonCode": 0,

"PublicId": "pk_********************************",

"TerminalUrl": "http://test.test",

"TransactionId": 891510444,

"Amount": 10,

"Currency": "MXN",

"CurrencyCode": 0,

"PaymentAmount": 10,

"PaymentCurrency": "MXN",

"PaymentCurrencyCode": 0,

"InvoiceId": "1234567",

"AccountId": "user_x",

"Email": null,

"Description": "Test",

"JsonData": null,

"CreatedDate": "/Date(1635150224630)/",

"PayoutDate": null,

"PayoutDateIso": null,

"PayoutAmount": null,

"CreatedDateIso": "2021-10-25T08:23:44",

"AuthDate": "/Date(1635150224739)/",

"AuthDateIso": "2021-10-25T08:23:44",

"ConfirmDate": null,

"ConfirmDateIso": null,

"AuthCode": "A1B2C3",

"TestMode": true,

"Rrn": null,

"OriginalTransactionId": null,

"FallBackScenarioDeclinedTransactionId": null,

"IpAddress": "123.123.123.123",

"IpCountry": "CN",

"IpCity": "Beijing",

"IpRegion": "Beijing",

"IpDistrict": "Beijing",

"IpLatitude": 39.9289,

"IpLongitude": 116.3883,

"CardFirstSix": "411111",

"CardLastFour": "1111",

"CardExpDate": "11/25",

"CardType": "Visa",

"CardProduct": "C",

"CardCategory": "Visa Signature (Signature)",

"EscrowAccumulationId": null,

"IssuerBankCountry": "MX",

"Issuer": "TipTop Pay",

"CardTypeCode": 0,

"Status": "Authorized",

"StatusCode": 2,

"CultureName": "kk",

"Reason": "Approved",

"CardHolderMessage": "Payment success",

"Type": 0,

"Refunded": false,

"Name": "CARDHOLDER NAME",

"Token": "0a0afb77-8f41-4de2-9524-1057f9695303",

"SubscriptionId": null,

"GatewayName": "Test",

"ApplePay": false,

"AndroidPay": false,

"WalletType": "",

"TotalFee": 0

},

"Success": true,

"Message": null

}

3-D Secure processing

To perform 3-D Secure authentication, you must direct the payer to the address specified in the AcsUrl parameter of the server response passing the following parameters:

- MD — TransactionId parameter from the server response;

- PaReq — eponymous parameter from the server response;

- TermUrl — the URL on your website to which the payer returns upon authentication.

EXAMPLE FORM:

<form name="downloadForm" action="AcsUrl" method="POST">

<input type="hidden" name="PaReq" value="eJxVUdtugkAQ/RXDe9mLgo0Z1nhpU9PQasWmPhLYAKksuEChfn13uVR9mGTO7MzZM2dg3qSn0Q+X\nRZIJxyAmNkZcBFmYiMgxDt7zw6MxZ+DFkvP1ngeV5AxcXhR+xEdJ6BhpEZnEYLBdfPAzg56JKSKT\nAhqgGpFB7IuSgR+cl5s3NqFTG2NAPYSUy82aETqeWPYUUAdB+ClnwSmrwtz/TbkoC0BtDYKsEqX8\nZfZkDGgAUMkTi8synyFU17V5N2nKCpBuAHRVs610VijCJgmZu17UXTxhFWP34l7evYPlegsHkO6A\n0C85o5hMsI3piNIZHc+IBaitg59qJYzgdrUOQK7/WNy+3FZAeSqV5cMqAwLe5JlQwpny8T8HdFW8\netFuBqUyahV+Hjf27vWCaSx22fe+KY6kXKZfJLK1x22TZkyUS8QiHaUGgDQN6s+H+tOq7O7kf8hd\nt30=">

<input type="hidden" name="MD" value="504">

<input type="hidden" name="TermUrl" value="https://example.com/post3ds?order=1234567">

</form>

<script>

window.onload = submitForm;

function submitForm() { downloadForm.submit(); }

</script>

Use the following Post3ds method to finalize the payment.

Method URL:

https://api.tiptoppay.mx/payments/cards/post3ds

Request parameters:

| PARAMETER | FORMAT | APPLICATION | DESCRIPTION |

|---|---|---|---|

| TransactionId | Long | Mandatory | MD value |

| PaRes | String | Mandatory | Eponymous parameter value |

In response to a correctly formed request, the server will either return a successful transaction report or one on a transaction declined.

Payments by token (recurring)

This method is intended for payment using the token received when paying by cryptogram or obtained via Pay.

Method URL::

https://api.tiptoppay.mx/payments/tokens/charge

Request parameters:

| PARAMETER | FORMAT | APPLICATION | DESCRIPTION |

|---|---|---|---|

| Amount | Number | Mandatory | Amount in transaction currency, separator: dot. Number of non-zero characters after dot: 2. |

| Currency | String | Opcional | Currency: USD/EUR/MXN (refer to the directory) |

| AccountId | String | Mandatory | User ID |

| TrInitiatorCode | Int | Opcional | Debiting initiator flag. Possible values: 0: the transaction was initiated by the merchant based on previously saved credentials; 1: the transaction was initiated by the cardholder (client) based on previously saved credentials. |

| Token | String | Mandatory | Token |

| InvoiceId | String | Opcional | Invoice or order number |

| Description | String | Opcional | Payment purpose in arbitrary form |

| IpAddress | String | Opcional | Payer's IP |

| String | Opcional | Payer's email address to which the payment receipt will be sent | |

| Payer | Object | Opcional | Additional field for payer information. Use the following parameters: FirstName, LastName, MiddleName, Birth, Street, Address, City, Country, Phone, Postcode |

| JsonData | Json | Opcional | Any other data to be associated with the transaction |

In response, the server returns a JSON with three components success field – the request result, message field – the error description, model object – additional information.

POSSIBLE VARIANTS

- Invalid request:

success — false

message — error description - Transaction declined:

success — false

model — transaction information and error code - Transaction accepted:

success — true

model — transaction information

Example token payment request::

{

"Amount":59,

"Currency":"MXN",

"InvoiceId":"1234567",

"Description":"Description example",

"AccountId":"user_x",

"Token":"success_1111a3e0-2428-48fb-a530-12815d90d0e8",

"Payer":

{

"FirstName":"Test",

"LastName":"Test",

"MiddleName":"Test",

"Birth":"1955-02-24",

"Address":"test address",

"Street":"Street",

"City":"City",

"Country":"MX",

"Phone":"123",

"Postcode":"345"

}

}

Response example: invalid request

{"Success":false,"Message":"Amount is required"}

Response example: transaction declined. ReasonCode field contains error code (refer to the directory)

{

"Model": {

"ReasonCode": 5051,

"PublicId": "pk_**********************************",

"TerminalUrl": "http://test.test",

"TransactionId": 891583633,

"Amount": 100,

"Currency": "MXN",

"CurrencyCode": 0,

"PaymentAmount": 100,

"PaymentCurrency": "MXN",

"PaymentCurrencyCode": 0,

"InvoiceId": "1234567",

"AccountId": "user_x",

"Email": null,

"Description": "Decription test",

"JsonData": null,

"CreatedDate": "/Date(1635154784619)/",

"PayoutDate": null,

"PayoutDateIso": null,

"PayoutAmount": null,

"CreatedDateIso": "2021-10-25T09:39:44",

"AuthDate": null,

"AuthDateIso": null,

"ConfirmDate": null,

"ConfirmDateIso": null,

"AuthCode": null,

"TestMode": true,

"Rrn": null,

"OriginalTransactionId": null,

"FallBackScenarioDeclinedTransactionId": null,

"IpAddress": "123.123.123.123",

"IpCountry": "CN",

"IpCity": "Beijing",

"IpRegion": "Beijing",

"IpDistrict": "Beijing",

"IpLatitude": 39.9289,

"IpLongitude": 116.3883,

"CardFirstSix": "400005",

"CardLastFour": "5556",

"CardExpDate": "12/25",

"CardType": "Visa",

"CardProduct": null,

"CardCategory": null,

"EscrowAccumulationId": null,

"IssuerBankCountry": "US",

"Issuer": "ITS Bank",

"CardTypeCode": 0,

"Status": "Declined",

"StatusCode": 5,

"CultureName": "mx",

"Reason": "InsufficientFunds",

"Type": 0,

"Refunded": false,

"Name": "CARDHOLDER NAME",

"Token": "tk_255c42192323f2e09ea17635302c3",

"SubscriptionId": null,

"GatewayName": "Test",

"ApplePay": false,

"AndroidPay": false,

"WalletType": "",

"TotalFee": 0

},

"Success": false,

"Message": null

}

Response example: transaction accepted

{

"Model": {

"ReasonCode": 0,

"PublicId": "pk_**************************",

"TerminalUrl": "http://test.test",

"TransactionId": 897728064,

"Amount": 59,

"Currency": "MXN",

"CurrencyCode": 0,

"PaymentAmount": 59,

"PaymentCurrency": "MXN",

"PaymentCurrencyCode": 0,

"InvoiceId": 1234567,

"AccountId": "user_x",

"Email": null,

"Description": "Decription test",

"JsonData": null,

"CreatedDate": "/Date(1635562705992)/",

"PayoutDate": null,

"PayoutDateIso": null,

"PayoutAmount": null,

"CreatedDateIso": "2021-10-30T02:58:25",

"AuthDate": "/Date(1635562706070)/",

"AuthDateIso": "2021-10-30T02:58:26",

"ConfirmDate": "/Date(1635562706070)/",

"ConfirmDateIso": "2021-10-30T02:58:26",

"AuthCode": "A1B2C3",

"TestMode": true,

"Rrn": null,

"OriginalTransactionId": null,

"FallBackScenarioDeclinedTransactionId": null,

"IpAddress": "87.251.91.164",

"IpCountry": "MX",

"IpCity": "City",

"IpRegion": "Region",

"IpDistrict": "District",

"IpLatitude": 55.03923,

"IpLongitude": 82.927818,

"CardFirstSix": "424242",

"CardLastFour": "4242",

"CardExpDate": "12/25",

"CardType": "Visa",

"CardProduct": "I",

"CardCategory": "Visa Infinite Infinite",

"EscrowAccumulationId": null,

"IssuerBankCountry": "MX",

"Issuer": "TipTop Pay",

"CardTypeCode": 0,

"Status": "Completed",

"StatusCode": 3,

"CultureName": "mx",

"Reason": "Approved",

"CardHolderMessage": "Payment has been successfully completed",

"Type": 0,

"Refunded": false,

"Name": "SER",

"Token": "success_1111a3e0-2428-48fb-a530-12815d90d0e8",

"SubscriptionId": null,

"GatewayName": "Test",

"ApplePay": false,

"AndroidPay": false,

"WalletType": "",

"TotalFee": 0

},

"Success": true,

"Message": null

}

Payment confirmation

Confirmation is required for two-step payments. Payments can be confirmed in your Personal Account or by invoking the API method.

Method URL:

https://api.tiptoppay.mx/payments/confirm

Request parameters:

| PARAMETER | FORMAT | APPLICATION | DESCRIPTION |

|---|---|---|---|

| TransactionId | Long | Mandatory | Transaction number in the system |

| Amount | Number | Mandatory | Confirmed amount in transaction currency, separator: dot. Number of non-zero characters after dot: 2. |

| JsonData | Json | Opcional | Any other data to be associated with the transaction |

Example request:

{"TransactionId":455,"Amount":65.98}

Response example:

{"Success":true,"Message":null}

Payment cancellation

Payments can be canceled in the Personal Account or by invoking the API method.

Method URL:

https://api.tiptoppay.mx/payments/void

Request parameters:

| PARAMETER | FORMAT | APPLICATION | DESCRIPTION |

|---|---|---|---|

| TransactionId | Long | Mandatory | Transaction number in the system |

Example request:

{"TransactionId":455}

Response example:

{"Success":true,"Message":null}

Refunds

Refunds can be effectuated in the Personal Account or by invoking the API method.

Method URL:

https://api.tiptoppay.mx/payments/refund

Request parameters:

| PARAMETER | FORMAT | APPLICATION | DESCRIPTION |

|---|---|---|---|

| TransactionId | Long | Mandatory | Payment transaction number |

| Amount | Number | Mandatory | Refund amount in transaction currency, separator: dot. Number of non-zero characters after dot: 2. |

| JsonData | Json | Opcional | Any other data to be associated with the transaction |

Example request:

{"TransactionId":455, "Amount": 100}

Response example:

{

"Model": {

"TransactionId": 568

},

"Success": true,

"Message": null

}

Cash payments

Method URL:

https://api.tiptoppay.mx/payments/altpay/pay

Example request:

{

"PublicId": "pk_**************************",

"Amount": 100,

"Currency": "MXN",

"Description": "A basket of oranges",

"CultureName": "en",

"PaymentUrl": "https://www.google.com",

"InvoiceId": "42",

"AccountId": "[email protected]",

"Scenario": 3,

"AltPayType": "CashOxxo",

"Scheme": 0,

"ReturnRedirectUrl": "{redirectUrl}"

"Email": "[email protected]",

"Payer": {

"FirstName": "Client",

"Email": "[email protected]"

}

}

Depending on the store selected in the POST: /payments/altpay/pay request, a specific AltPayType will be sent

Convenience stores:

AltPayType = CashCStoresOXXO:

AltPayType = CashOxxoPharmacies:

AltPayType = CashFarmacias

SPEI payment

Method URL:

https://api.tiptoppay.mx/payments/altpay/pay

Example request:

{

"PublicId": "pk_**************************",

"AltPayType": 5,

"Scenario": 3,

"Amount": 111,

"Currency": "MXN",

"Description": "SPEI",

"Email": "[email protected]",

"InvoiceId": "20",

"JsonData": null,

"CultureName": "es-ES"

}

Response example:

{

"Model": {

"transactionId": 0,

"providerTransactionId": "string",

"status": "Unknown",

"statusCode": 0,

"extensionData": {

"clabe": 0,

"expiredDate": "2022-07-10T05:05:40.078Z",

"link": "string",

"gateway": "string"

},

"amount": 0,

},

"Success": true,

"Message": "string"

}

Response example: Invalid request format

{

"ErrorCode": "400",

}

Response example: CLABE account has already been generated for this TransactionID

{

"ErrorCode": "401",

"ErrorMessage": "CLABE account has already been generated for this TransactionID"

}

Response example: All unique values for the CLABE account are occupied

{

"ErrorCode": "402",

"ErrorMessage": "All unique values for the CLABE account are occupied"

}

Response example: Internal server error

{

"ErrorCode": "500",

}

Creating a subscription with recurring payments

The method for creating a subscription with recurring payments.

Method URL:

https://api.tiptoppay.mx/subscriptions/create

Request parameters:

| PARAMETER | FORMAT | APPLICATION | DESCRIPTION |

|---|---|---|---|

| Token | String | Mandatory | Card token issued by system after initial payment |

| AccountId | String | Mandatory | User ID |

| Description | String | Mandatory | Payment purpose in arbitrary form |

| String | Opcional | Payer's email | |

| Amount | Number | Mandatory | Amount in transaction currency, separator: dot. Number of non-zero characters after dot: 2. |

| Currency | String | Mandatory | Currency: USD/EUR/MXN (refer to the directory) |

| RequireConfirmation | Bool | Mandatory | If "true", the payments will be processed under the two-step scheme |

| StartDate | DateTime | Mandatory | The date and time of the plan's first payment in the UTC timezone. The value has to be dated in the future |

| Interval | String | Mandatory | Interval. Available values: Day, Week, Month |

| Period | Int | Mandatory | Period. Combined with interval; 1 Month means once a month; 2 Weeks means every two weeks. Must be above 0 |

| MaxPeriods | Int | Opcional | Maximum number of payments per subscription. If specified, must be greater than 0 |

In response to a correctly generated request, the system will return a message reporting a completed transaction and a subscription ID.

Example request:

{

"token": "477BBA133C182267FE5F086924ABDC5DB71F77BFC27F01F2843F2CDC69D89F05",

"accountId": "user_x",

"description": "Subscription on example.com",

"email": "[email protected]",

"amount": 399,

"Currency": "MXN",

"requireConfirmation": false,

"startDate": "2021-11-02T21:00:00",

"interval": "Day",

"period": 5

}

Response example:

{

"Model": {

"Id": "sc_221da6421dc44dbd2cc3464f6f083",

"AccountId": "user_x",

"Description": "Subscription on example.com",

"Email": "[email protected]",

"Amount": 399,

"CurrencyCode": 0,

"Currency": "MXN",

"RequireConfirmation": false,

"StartDate": "/Date(1635886800000)/",

"StartDateIso": "2021-11-02T21:00:00",

"IntervalCode": 2,

"Interval": "Day",

"Period": 5,

"MaxPeriods": null,

"CultureName": "mx",

"StatusCode": 0,

"Status": "Active",

"SuccessfulTransactionsNumber": 0,

"FailedTransactionsNumber": 0,

"LastTransactionDate": null,

"LastTransactionDateIso": null,

"NextTransactionDate": "/Date(1635886800000)/",

"NextTransactionDateIso": "2021-11-02T21:00:00",

"FailoverSchemeId": null

},

"Success": true,

"Message": null

}

Requesting subscription details

The method for obtaining subscription status info.

Method URL:

https://api.tiptoppay.mx/subscriptions/get

Request parameters:

| PARAMETER | FORMAT | APPLICATION | DESCRIPTION |

|---|---|---|---|

| Id | String | Mandatory | Subscription ID |

Example request:

{"Id":"sc_8cf8a9338fb8ebf7202b08d09c938"}

Response example:

{

"Model": {

"Id": "sc_8cf8a9338fb8ebf7202b08d09c938",

"AccountId": "user_x",

"Description": null,

"Email": "[email protected]",

"Amount": 399,

"CurrencyCode": 0,

"Currency": "MXN",

"RequireConfirmation": false,

"StartDate": "/Date(1635886800000)/",

"StartDateIso": "2021-11-02T21:00:00",

"IntervalCode": 2,

"Interval": "Day",

"Period": 5,

"MaxPeriods": null,

"CultureName": "mx",

"StatusCode": 3,

"Status": "Cancelled",

"SuccessfulTransactionsNumber": 0,

"FailedTransactionsNumber": 0,

"LastTransactionDate": null,

"LastTransactionDateIso": null,

"NextTransactionDate": null,

"NextTransactionDateIso": null,

"Receipt": null,

"FailoverSchemeId": null

},

"Success": true,

"Message": null

}

Subscription search

The method for obtaining a list of subscriptions for a specific account.

Method URL:

https://api.tiptoppay.mx/subscriptions/find

Request parameters:

| PARAMETER | FORMAT | APPLICATION | DESCRIPTION |

|---|---|---|---|

| accountId | String | Mandatory | User ID |

Example request:

{"accountId":"[email protected]"}

Response example:

{

"Model": [

{

"Id": "sc_221da6421dc44dbd2cc3464f6f083",

"AccountId": "user_x",

"Description": null,

"Email": "[email protected]",

"Amount": 399,

"CurrencyCode": 0,

"Currency": "MXN",

"RequireConfirmation": false,

"StartDate": "/Date(1635886800000)/",

"StartDateIso": "2021-11-02T21:00:00",

"IntervalCode": 2,

"Interval": "Day",

"Period": 5,

"MaxPeriods": null,

"CultureName": "mx",

"StatusCode": 3,

"Status": "Cancelled",

"SuccessfulTransactionsNumber": 0,

"FailedTransactionsNumber": 0,

"LastTransactionDate": null,

"LastTransactionDateIso": null,

"NextTransactionDate": null,

"NextTransactionDateIso": null,

"FailoverSchemeId": null

},

{

"Id": "sc_3ffc96c001e152b341817341b075a",

"AccountId": "user_x",

"Description": null,

"Email": "[email protected]",

"Amount": 999,

"CurrencyCode": 0,

"Currency": "MXN",

"RequireConfirmation": false,

"StartDate": "/Date(1635973200000)/",

"StartDateIso": "2021-11-03T21:00:00",

"IntervalCode": 2,

"Interval": "Day",

"Period": 5,

"MaxPeriods": null,

"CultureName": "mx",

"StatusCode": 0,

"Status": "Active",

"SuccessfulTransactionsNumber": 0,

"FailedTransactionsNumber": 0,

"LastTransactionDate": null,

"LastTransactionDateIso": null,

"NextTransactionDate": "/Date(1635973200000)/",

"NextTransactionDateIso": "2021-11-03T21:00:00",

"FailoverSchemeId": null

}

],

"Success": true,

"Message": null

}

Modifying a subscription with recurring payments

Method for modifying an existing subscription.

Method URL:

https://api.tiptoppay.mx/subscriptions/update

Request parameters:

| PARAMETER | FORMAT | APPLICATION | DESCRIPTION |

|---|---|---|---|

| Id | String | Mandatory | Subscription ID |

| Description | String | Opcional | To change the payment purpose |

| Amount | Number | Opcional | To change the payment amount in the respective currency, separator: dot. Number of non-zero characters after dot: 2. |

| Currency | String | Opcional | Currency: USD/EUR/MXN (refer to the directory) |

| RequireConfirmation | Bool | Opcional | To change the payment scheme |

| StartDate | DateTime | Opcional | To change the date and time of the first or subsequent payment in the UTC timezone |

| Interval | String | Opcional | To change the interval. Available values: Day, Week, Month |

| Period | Int | Opcional | To change the period. In combination with interval; 1 Month means once a month; 2 Week means every two weeks |

| MaxPeriods | Int | Opcional | To change the maximum number of payments per subscription |

| CultureName | String | Opcional | Notification language |

In response to a correctly generated request, the system will return a message reporting a completed transaction and subscription parameters.

Example request:

{

"Id":"sc_3ffc96c001e152b341817341b075a",

"description":"changing recurrence",

"amount":499,

"Currency":"MXN"

}

Response example:

{

"Model": {

"Id": "sc_3ffc96c001e152b341817341b075a",

"AccountId": "user_x",

"Description": "changing recurrence",

"Email": "[email protected]",

"Amount": 499,

"CurrencyCode": 0,

"Currency": "MXN",

"RequireConfirmation": false,

"StartDate": "/Date(1635973200000)/",

"StartDateIso": "2021-11-03T21:00:00",

"IntervalCode": 2,

"Interval": "Day",

"Period": 2,

"MaxPeriods": null,

"CultureName": "mx",

"StatusCode": 0,

"Status": "Active",

"SuccessfulTransactionsNumber": 0,

"FailedTransactionsNumber": 0,

"LastTransactionDate": null,

"LastTransactionDateIso": null,

"NextTransactionDate": "/Date(1635973200000)/",

"NextTransactionDateIso": "2021-11-03T21:00:00",

"FailoverSchemeId": null

},

"Success": true,

"Message": null

}

Cancelling a subscription with recurring payments

The method for canceling a subscription with recurring payments.

Method URL:

https://api.tiptoppay.mx/subscriptions/cancel

Request parameters:

| PARAMETER | FORMAT | APPLICATION | DESCRIPTION |

|---|---|---|---|

| Id | String | Mandatory | Subscription ID |

In response to a correctly generated request, the system will return a message reporting a completed transaction.

Example request:

{"Id":"sc_cc673fdc50b3577e60eee9081e440"}

Response example:

{"Success":true,"Message":null}

Request for terminal settings

Method to retrieve available payment methods by public ID of the terminal, passed in Query parameter.

Method URL:

https://api.tiptoppay.mx/merchant/configuration/?terminalPublicId=?&paymentUrl=?&language=?

Request parameters:

| No. | Name | Type | Data type | Description |

|---|---|---|---|---|

| 1 | terminalPublicId | query | string | public ID of the terminal |

| 2 | paymentUrl | query | string | address of the website from which invocation is made |

| 3 | language | query | enum |

localization |

Example request:

https://api.tiptoppay.mx/merchant/configuration/?terminalPublicId=pk_798df82a361070a52485c827dc6f4&paymentUrl=https%3A%2F%2Fdemo-pre-mx.tiptoppay.mx&language=es

Response example:

{

"Model": {

"LogoUrl": "https://static.tiptoppay.mx/test_api_00000000000000000000002/logo.PNG",

"TerminalUrl": "demo.tiptoppay.mx",

"TerminalFullUrl": "https://demo.tiptoppay.mx",

"WidgetUrl": "https://widget.tiptoppay.mx/",

"IsCharity": false,

"IsTest": true,

"TerminalName": "Demo site",

"SkipExpiryValidation": true,

"AgreementPath": "",

"IsCvvRequired": true,

"ExternalPaymentMethods": [

{

"Type": 16,

"Enabled": true

}

],

"Features": {

"IsAllowedNotSanctionedCards": true,

"IsQiwi": false,

"IsForeignCurrencyGateway": false,

"IsSaveCard": 2,

"IsPayOrderingEnabled": true,

"IsThreeCardInput": true

},

"SupportedCards": [

0,

1,

2,

3,

4,

5,

6,

7,

8,

9,

10,

11,

12,

13,

14,

15,

16,

17,

100

],

"DisplayAdvertiseBannerOnWidget": false,

"BannerAdvertiseUrl": null,

"Status": 0

},

"Success": true,

"Message": null,

"ErrorCode": null

}

Retrieving details for installment payment by card

The endpoint is designed to retrieve the installment periods available for installment purchases and the approximate monthly payment amount for these periods.

Method URL:

https://api.tiptoppay.mx/installments/calculate/sum-by-period?amount=&terminalPublicId=

Request parameters:

| No. | Name | Type | Data type | Description |

|---|---|---|---|---|

| 1 | terminalPublicId | query | string | public ID of the terminal |

| 2 | amount | query | decimal | installment payment by card amount |

Example request:

https://api.tiptoppay.mx/installments/calculate/sum-by-period?terminalPublicId=pk_798df82a361070a52485c827dc6f4&amount=110

Response example:

{

"Model": {

"IsCardInstallmentAvailable": true,

"Configuration": [

{

"Term": 3,

"MonthlyPayment": 36.67

}

]

},

"Success": true,

"Message": null,

"ErrorCode": null

}

Checking card by bin

The method is designed to retrieve accurate bank card details by the first 6, 7, or 8 digits of its number.

Method URL:

https://api.tiptoppay.mx/bins/info?Bin=¤cy=&amount=&isAllowedNotSanctionedCards=&isQiwi=&IsCheckCard=&TerminalPublicId=&SevenNumberHash=&EightNumberHash=

Request parameters:

| Field | Type | Data type | Description |

|---|---|---|---|

| Bin | query | string | first 6 digits of the card number |

| currency | query | string | transaction currency |

| amount | query | decimal | transaction amount |

| isAllowedNotSanctionedCards | query | boolean | support for non-sanctioned cards |

| isQiwi | query | boolean | whether the gateway from which the payment is made is a Qiwi gateway |

| isForeignCurrencyGateway | query | boolean | the gateway from which the payment is made is limited to transactions in foreign currency |

| SevenNumberHash | query | string | hash of the first 7 digits of the card number |

| EightNumberHash | query | string | hash of the first 8 digits of the card number |

| TerminalPublicId | query | string | public ID of the terminal; required to check the card for installment payment eligibility |

| IsCheckCard | query | boolean | used for checking card for installment payments true: check the card false: do not check the card mandatory: pass the value true to check the card for installment payment eligibility |

Example request:

https://api.tiptoppay.mx/bins/info?Bin=400000¤cy=MXN&amount=110&isAllowedNotSanctionedCards=true&isQiwi=false&IsCheckCard=true&TerminalPublicId=pk_798df82a361070a52485c827dc6f4&SevenNumberHash=5033663954b22fc24d494bbf51402ee403bafc1ff40f35b7a1f5ae4e9e4b0ffe7598574ea0c8e56597f69b6f617a5fb37c278b3273c3ff6df3d6f9f4e16af052&EightNumberHash=68a1a1fd4de784e3a2e0e956d0a63ac4ca540ef90e7fd9a2ddc92cf68e52e29792db64f6615054a6e5460467f0b7abe055c899136d98ce6ebab3d580bc55ec86

Response example:

{

"Model": {

"LogoUrl": "",

"BankName": "Bank Banorte Mexico",

"Currency": null,

"ConvertedAmount": null,

"HideCvvInput": false,

"CardType": null,

"CountryCode": 484,

"IsCardAllowed": true

},

"Success": true,

"Message": null,

"ErrorCode": null

}

Notifications

Notification is an HTTP request from the system to your site. Similar requests are also called callback or webhook. The system provides several types of notifications: check whether it is possible to make a payment, information about successful and unsuccessful payments.

Check

The Check notification is performed once a cardholder filled in a payment form and pressed the “Pay” button. It serves the purpose of payment validation: the system sends a request to a merchant's website address with payment information, and the website must validate and define if it's needed to confirm or reject the payment.

The list of parameters transmitted in the request body is presented in the table:

| Parameter | Format | Use | Description |

|---|---|---|---|

| TransactionId | Numeric | Required | Transaction number in the system |

| Amount | Numeric, dot as separator, two digits after dot | Required | Amount specified in payment parameters |

| Currency | String | Required | Currency: MXN specified in payment parameters (see reference) |

| DateTime | yyyy-MM-dd HH:mm:ss | Required | Payment creation date / time in the UTC time zone |

| CardFirstSix | String(6) | Required | First 6 digits of a card number |

| CardLastFour | String(4) | Required | Last 4 digits of a card number |

| CardType | String | Required | Card Payment System: Visa, MasterCard, American Express, or Carnet |

| CardExpDate | String | Required | Expiration date in MM/YY format |

| TestMode | Bit (1 or 0) | Required | Test mode sign |

| Status | String | Required | Payment status if successful: Completed — for SMS sheme |

| OperationType | String | Required | Transaction type: Payment/Refund |

| InvoiceId | String | Optional | Order number specified in payment parameters |

| Name | String | Optional | Cardholder's name |

| String | Optional | Payer's E-mail address | |

| IpAddress | String | Optional | Payer's IP address |

| IpCountry | String(2) | Optional | Two-letter code of a country of a payer's location by ISO3166-1 |

| IpCity | String | Optional | Payer's location city |

| IpRegion | String | Optional | Payer's location region |

| IpDistrict | String | Optional | Payer's location district |

| Issuer | String | Optional | Name of a card issuing bank |

| IssuerBankCountry | String(2) | Optional | Two-letter country code of a card issuer by ISO3166-1 |

| Description | String | Optional | Payment description specified in payment parameters |

The system expects a response in JSON format with the required parameter code:

{"code":0}

The code defines a payment result and can take the following values:

| Code | Description | Result |

|---|---|---|

| 0 | Payment can be done | The system will authorize a payment |

| 10 | Invalid order number | Payment will be declined |

| 11 | Invalid AccountId | Payment will be declined |

| 12 | Invalid amount | Payment will be declined |

| 13 | Payment cannot be accepted | Payment will be declined |

| 20 | Payment overdue | Payment will be declined, a payer will receive a notification |

Pay

The Pay notification is performed once a payment is successfully completed and an issuer's authorization is received.

It serves the purpose of information about a payment: the system sends a request to a merchant's website address with payment information, and the merchant's site has to register the fact of payment.

The list of parameters transmitted in the request body is presented in the table:

| Parameter | Format | Use | Description |

|---|---|---|---|

| TransactionId | Numeric | Required | Transaction number in the system |

| Amount | Numeric, dot as separator, two digits after dot | Required | Amount specified in payment parameters |

| Currency | String | Required | Currency: MXN specified in payment parameters (see reference) |

| DateTime | yyyy-MM-dd HH:mm:ss | Required | Payment creation date / time in the UTC time zone |

| CardFirstSix | String(6) | Required | First 6 digits of a card number |

| CardLastFour | String(4) | Required | Last 4 digits of a card number |

| CardType | String | Required | Card Payment System: Visa, MasterCard, American Express, or Carnet |

| CardExpDate | String | Required | Expiration date in MM/YY format |

| TestMode | Bit (1 or 0) | Required | Test mode sign |

| Status | String | Required | Payment status once authorized: Completed — for SMS sheme |

| OperationType | String | Required | Operation type: Payment/Refund |

| GatewayName | String | Required | Acquiring Bank Identifier |

| InvoiceId | String | Optional | Order or Invoice number specified in payment parameters |

| Name | String | Optional | Cardholder's name |

| String | Optional | Payer's E-mail address | |

| IpAddress | String | Optional | Payer's IP address |

| IpCountry | String(2) | Optional | The Two-letter code of a country of a payer's location by ISO3166-1 |

| IpCity | String | Optional | Payer's location city |

| IpRegion | String | Optional | Payer's location region |

| IpDistrict | String | Optional | Payer's location district |

| Issuer | String | Optional | Name of a card issuing bank |

| IssuerBankCountry | String(2) | Optional | Two-letter country code of a card issuer by ISO3166-1 |

| Description | String | Optional | Payment description specified in payment parameters |

| TotalFee | Decimal | Required | Total fee value |

| CardProduct | String | Optional | Card Product Type |

| Rrn | String | Optional | RRN is a unique transaction identifier assigned by the acquiring bank |

| CustomFields | Array | Optional | The custom fields that the merchant passes in the payment request |

The system expects a response in JSON format with the required parameter code:

{"code":0}

The code defines a payment result and can take only one value:

| Code | Value |

|---|---|

| 0 | Payment is registered |

Fail

The Fail notification is performed if a payment was declined and is used to analyze a number and causes of failures.

You need to consider that a fact of decline is not final since a user can pay the second time.

The list of parameters transmitted in the request body is presented in the table:

| Parameter | Format | Use | Description |

|---|---|---|---|

| TransactionId | Numeric | Required | Transaction number in the system |

| Amount | Numeric, dot as separator, two digits after dot | Required | Amount specified in payment parameters |

| Currency | String | Required | Currency: MXN specified in the payment parameters (see reference) |

| DateTime | yyyy-MM-dd HH:mm:ss | Required | Payment creation date / time in the UTC time zone |

| CardFirstSix | String(6) | Required | First 6 digits of a card number |

| CardLastFour | String(4) | Required | Last 4 digits of a card number |

| CardType | String | Required | Card Payment System: Visa, MasterCard, American Express, or Carnet |

| CardExpDate | String | Required | Expiration date in MM/YY format |

| TestMode | Bit (1 or 0) | Required | Test mode sign |

| Reason | String | Required | Decline reason |

| ReasonCode | Int | Required | Error Code (see the reference) |

| OperationType | String | Required | Operation type: Payment/Refund |

| InvoiceId | String | Optional | Order or Invoice number specified in payment parameters |

| Name | String | Optional | Cardholder's name |

| String | Optional | Payer's E-mail address | |

| IpAddress | String | Optional | Payer's IP address |

| IpCountry | String(2) | Optional | The Two-letter code of a country of a payer's location by ISO3166-1 |

| IpCity | String | Optional | Payer's location city |

| IpRegion | String | Optional | Payer's location region |

| IpDistrict | String | Optional | Payer's location district |

| Issuer | String | Optional | Name of a card issuing bank |

| IssuerBankCountry | String(2) | Optional | Two-letter country code of a card issuer by ISO3166-1 |

| Description | String | Optional | Payment description specified in payment parameters |

| Rrn | String | Optional | RRN is a unique transaction identifier assigned by the acquiring bank |

| CustomFields | Array | Optional | The custom fields that the merchant passes in the payment request |

The system expects a response in JSON format with the required parameter code:

{"code":0}

The code defines a payment result and can take only one value:

| Code | Value |

|---|---|

| 0 | Attempt is registered |

Refund

The Refund notification is performed if a payment was refunded (fully or partially) on your initiative via Control panel.

The list of parameters transmitted in the request body is presented in the table:

| Parameter | Format | Use | Description |

|---|---|---|---|

| TransactionId | Numeric | Required | Refund transaction number in the system |

| PaymentTransactionId | Int | Required | Payment transaction number in the system (original) |

| Amount | Numeric, dot as separator, two digits after dot | Required | Refund amount in payment currency |

| DateTime | yyyy-MM-dd HH:mm:ss | Required | Refund date / time in UTC time zone |

| OperationType | String | Required | Operation type: Payment/Refund |

| InvoiceId | String | Optional | Invoice or Order number of the original transaction |

| AccountId | String | Optional | Payer's ID of the original transaction |

| String | Optional | Payer's E-mail address | |

| Rrn | String | Optional | RRN is a unique transaction identifier assigned by the acquiring bank |

| CustomFields | Array | Optional | The custom fields that the merchant passes in the payment request |

The system expects a response in JSON format with the required parameter code:

{"code":0}

The code defines a payment result and can take only one value:

| Code | Value |

|---|---|

| 0 | Refund is registered |

Notification Validation

All the notifications — check, pay, fail and refund - have the X-Content-HMAC and Content-HMAC HTTP headers which contains a validation value of a request which is calculated using the HMAC algorithm. The only difference is that the first one is generated from URL decoded (or not encoded) parameters, and the second one is generated from URL encoded parameters (which can cause problems). If you need to verify authenticity and integrity of notifications, you can calculate a validation value on your side and compare it with the request value. The coincidence confirms that you received the notification we sent in the original form.

Please pay attention to the following points when implementing notification validation:

- For notifications sent by POST method the message is represented by a request body. For GET method it is string parameters;

- When calculating HMAC, use UTF8 encoding;

- Hash is calculated by SHA256 function;

- The secret API is used as a key, which can be obtained in your Control panel;

- The calculated value is passed in base64 encoding.

HMAC calculation Examples in different programming languages.

The system sends notifications from the following addresses: 54.176.98.0/32.

For you, this means that:

- If you do not use Pay / Check / Fail / Refund notifications, then you do not need to do anything;

- If you are using at least one of these notifications, then you need to check which https encryption protocols your server supports. If your server only supports SSL3, then you need to upgrade it to at least TLS11. It will be even better if you upgrade to TLS13. As a last resort, you can translate notifications to the http protocol.

Learn more how to opt out of SSL3. After June 8, https notifications to servers that support only SSL3 may not be delivered.

Installment payment by card

TipTop Pay offers installment payments by card as a payment method. Installment payments by card are only available to holders of credit cards issued with a Mexican bank. To activate installment payments, contact your personal manager at TipTop Pay.

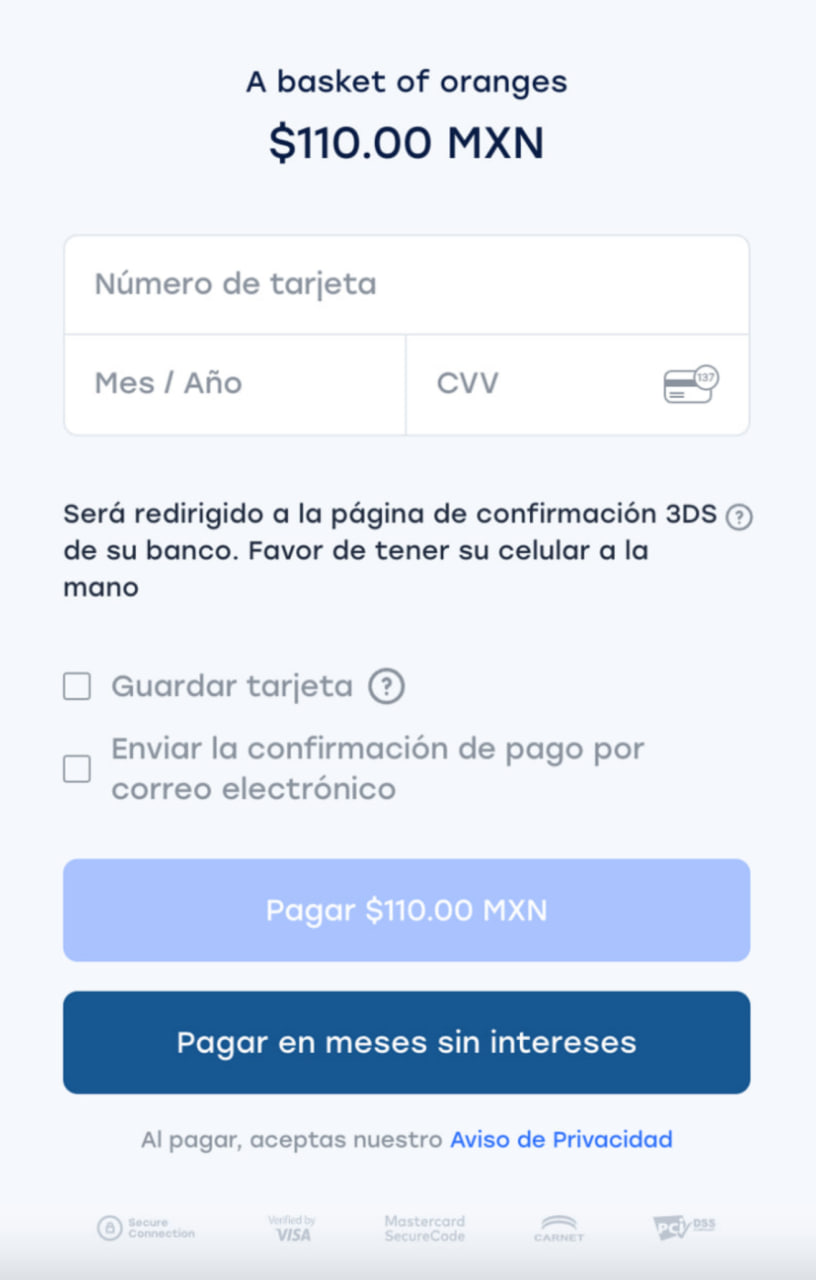

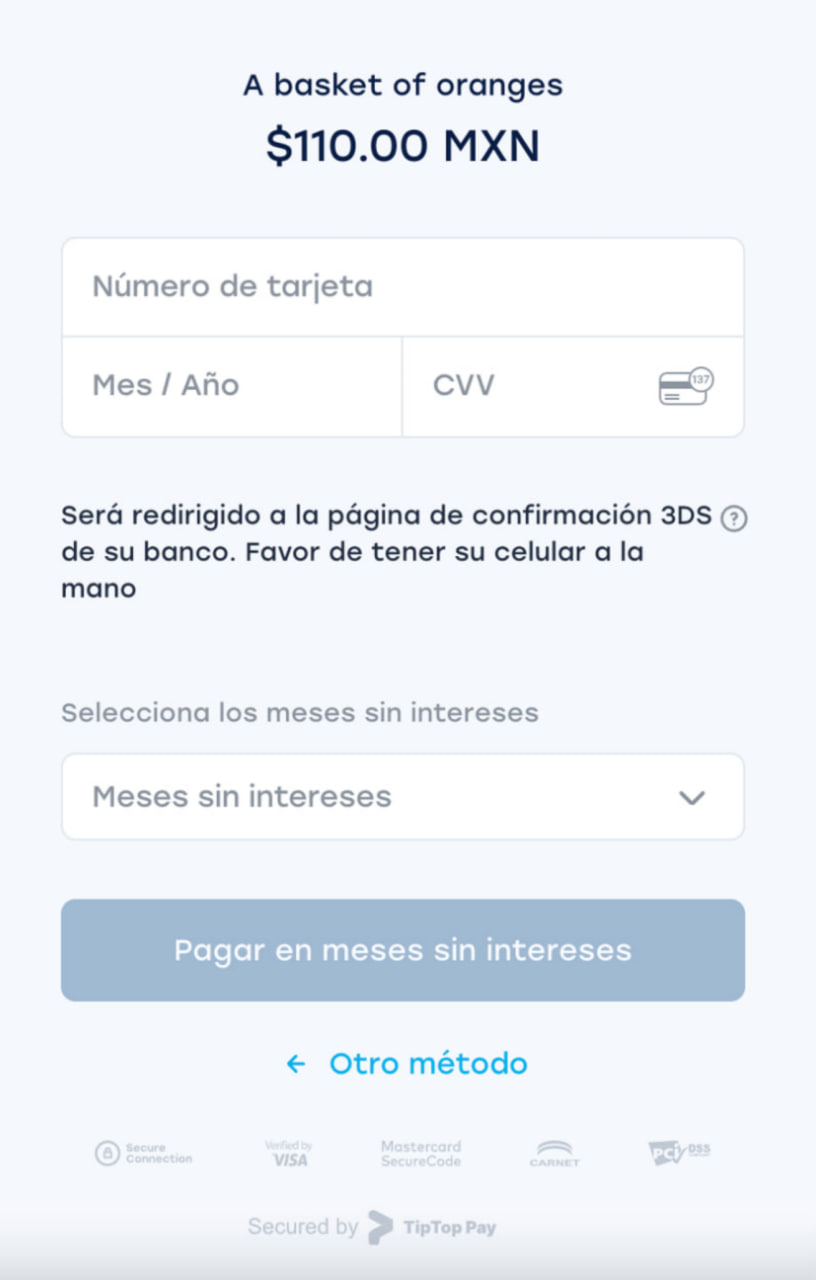

Installment payments in the widget

If the website allows installment payment for goods, the widget shows the client a button called "Pagar en meses sin intereses"; by clicking it, the client proceeds to a separate page of the widget.

On the installment payment page, the client must enter card details*, select the installment period* and click Pay.

*Requirements for card details and available installment periods can be clarified with your personal manager at TipTop Pay.

To integrate installment payments by card, the following procedure is required:

- Check if your website allows installment payments by card; to check, invoke the method

GET: /merchant/configuration/?terminalPublicId=&paymentUrl=&language=- If the response contains the array "ExternalPaymentMethods" with

{ "Type": 16, "Enabled": true }, then installment payments are allowed on your website. Proceed to the next step. - Otherwise, installment payments are not available at your terminal.

- If the response contains the array "ExternalPaymentMethods" with

- Retrieve the available installment payment periods and the approximate monthly payment amount for these periods to pay for this purchase. To do this, invoke the method

GET: api/installments/calculate/sum-by-period?amount=&terminalPublicId=- If the response contains

IsCardInstallmentAvailable:false, then it is not possible to pay for this purchase in installments. - If the response contains

IsCardInstallmentAvailable:true, then theConfigurationarray will be retrieved with the periods to pay for this installment purchase and the approximate monthly payment amount for each period.

- If the response contains

- To make an installment payment, the client must enter card details that meet the requirements for installment payments, select the installment period, and click Pay.

- You can perform checks for card details on your side or use our mechanism to check cards for installment payment eligibility.

- In order to check card details for installment payment eligibility in the TipTopPay system, invoke

GET: bins/info; in Path params, in addition to the fields with the card number, passIsCheckCard:true,TerminalPublicId: <your TerminalPublicId>.- If the response contains

IsCardAllowed:truefield, then the card is eligible for installment payments. - If the response contains

IsCardAllowed:falsefield, then the card is ineligible for installment payment. The client must use a different card. Installment payment attempts with such a card will be rejected with an error message.

- If the response contains

- In order to check card details for installment payment eligibility in the TipTopPay system, invoke

- You can perform checks for card details on your side or use our mechanism to check cards for installment payment eligibility.

- To execute an installment payment request, invoke the method

POST: /payments/cards/charge; in its body, pass the installment data in the InstallmentData field. See the field description in the/payments/cards/chargemethod description. In response, the data for 3DS is retrieved. - Execute 3DS on installment payments by card. The 3DS process is identical to the 3DS process for a card payment without installments. For a description of the 3DS process, see the corresponding section.

- After completing 3DS, the result of the installment payment by card will be retrieved. See the payment result field description in the

/payments/cards/chargemethod response fields description

Integration Scenarios

The system offers various integration options from very simple to infinitely functional depending on the requirements.

Payment Form

If you do not need to check payments before payment and record a fact after payment:

- Add the widget script on your site;

- Specify an email address for payment notifications in Control panel.

Payment Registering

If you need to register payments in your system without pre-check, then your actions are:

- Add the script on your site;

Make a payment registering:

- Create a handler for Pay notification, for example https://site.com/webhooks/tiptoppay/pay;

- Provide a logic of a payment registration in the handler and a response in JSON format;

- Enable the Pay notifications function in Control panel.

Payment Checking and Registering

If you need to check and register payments in your system, then your actions are:

- Add the widget script on your site;

Make a payment checking:

- Create a handler for Check notification, for example on, https://site.com/webhooks/tiptoppay/check;

- Provide a logic of a payment registration in the handler and a response in JSON format;

Make a payment registering:

- Create a handler for Pay notification, for example on, https://site.com/webhooks/tiptoppay/pay;

- Provide a logic of a payment registration in the handler and a response in JSON format;

Enable the Check and Pay notifications function in Control panel.

Testing

Once you have an access to Control panel, it is in a test mode already which means that payments and other operations will take place in emulation mode.

For testing, you can use the following card data:

| Type | Card Number | Payment result |

|---|---|---|

| Card Visa with 3-D Secure | 4242 4242 4242 4242 | Successful result |

| Card MasterCard with 3-D Secure | 5555 5555 5555 4444 | Successful result |

| Card Visa with 3-D Secure | 4012 8888 8888 1881 | Insufficient funds |

| Card MasterCard with 3-D Secure | 5105 1051 0510 5100 | Insufficient funds |

Reference

Error Codes

You can see the error codes below that determine the reason of payment rejection.

The payment widget displays an error message automatically.

| Code | Name | Reason | Message for payer |

|---|---|---|---|

| 5001 | Refer To Card Issuer | Issuer declined the operation | Contact your bank or use another card |

| 5003 | Invalid Merchant | Issuer declined the operation | Contact your bank or use another card |

| 5004 | Pick Up Card | Lost Card | Contact your bank or use another card |

| 5005 | Do Not Honor | Issuer declined without explanation - CVV code is incorrect for MasterCard; - Issuer Bank internal limitations; - card is locked or not activated yet; - card is not allowed for online payments or has no 3-D secure. |

Contact your bank or use another card |

| 5006 | Error | Network failure to perform an operation or incorrect CVV code | Check the correctness of entered card data or use another card |

| 5007 | Pick Up Card Special Conditions | Lost Card | Contact your bank or use another card |

| 5012 | Invalid Transaction | The card is not intended for online payments | Contact your bank or use another card |

| 5013 | Amount Error | Too small or too large transaction amount | Check the correctness of the amount |

| 5014 | Invalid Card Number | Invalid Card Number | Check the correctness of entered card data or use another card |

| 5015 | No Such Issuer | Unknown card issuer | Use another card |

| 5019 | Transaction Error | Issuer declined without explanation - CVV code is incorrect for MasterCard; - Issuer Bank internal limitations; - card is locked or not activated yet; - card is not allowed for online payments or has no 3-D secure. |

Contact your bank or use another card |

| 5030 | Format Error | Error on the side of the acquirer - incorrectly formed transaction | Try again later |

| 5031 | Bank Is Not Supported By Switch | Unknown card issuer | Use another card |

| 5033 | Expired Card Pickup | Expired Card Pickup | Contact your bank or use another card |

| 5034 | Suspected Fraud | Issuer failure - fraud is suspected | Contact your bank or use another card |

| 5036 | Restricted Card | The card is not intended for online payments | Contact your bank or use another card |

| 5041 | Lost Card | Lost Card | Contact your bank or use another card |

| 5043 | Stolen Card | Stolen Card | Contact your bank or use another card |

| 5051 | Insufficient Funds | Insufficient Funds | Insufficient Funds |

| 5054 | Expired Card | Card is expired or expiration date is incorrect | Check the correctness of entered card data or use another card |

| 5057 | Transaction Is Not Permitted | Card limitation — internal limitations of Issuer — card is locked or not activated yet; — card is not allowed for online payments or has no 3-D secure. |

Contact your bank or use another card |

| 5062 | Restricted Card 2 | The card is not intended for online payments | Contact your bank or use another card |

| 5063 | Security Violation | The card is blocked by security violation | Use another card |

| 5065 | Exceed Withdrawal Frequency | Card transactions limit is exceeded | Contact your bank or use another card |

| 5082 | Incorrect CVV | Incorrect CVV code | Incorrect CVV code |

| 5091 | Timeout | Issuer is not available | Try again later or use another card |

| 5092 | Cannot Reach Network | Issuer is not available | Try again later or use another card |

| 5096 | System Error | Acquiring bank or network error | Try again later |

| 5204 | Unable To Process | The operation cannot be processed for other reasons | Contact your bank or use another card |

| 5206 | Authentication failed | 3-D secure Authentication failed | Contact your bank or use another card |

| 5207 | Authentication unavailable | 3-D secure Authentication unavailable | Contact your bank or use another card |

| 5300 | Anti Fraud | Acquirer Transaction Limits | Use another card |

| 5303 | Acquirer Terminal Limits Exceeded | Exceeding the limit on the terminal | Contact your bank or use another card |

| 5302 | Automatic authentication retry | 3DS authentication is requested by Antifraud, a subsequent transaction will be created automatically | – |

| 6018 | Payment method not supported | Currently selected payment method is not supported | Use another payment method |

| 6019 | Amount limit not found | Amount limits for conducting transactions using the selected payment method are not configured | Use another payment method |

| 6020 | Installment period not found | Installment period for conducting transactions using the selected payment method are not configured | Use another payment method |

Check notitifcation processig responses

You can see the codes below how system registers your replies on check notification.

| Code | Name | Reason |

|---|---|---|

| 3001 | InvalidInvoiceId | Callback handler returned {"code":10} |

| 3002 | InvalidAccountId | Callback handler returned {"code":11} |

| 3003 | InvalidAmount | Callback handler returned {"code":12} |

| 3004 | OutOfDate | Callback handler returned {"code":20} |

| 3005 | FormatError | Callback handler returned a different code from expected |

| 3006 | Unavailable | Service unavailable |

| 3007 | UnableToConnect | Unable to connect (404, 504, 508 etc) |

| 3008 | NotAccepted | Callback handler returned {"code":13} |

Operation Types